For many retirees, having enough money to enjoy a satisfying retirement is a major concern. Fortunately, enjoying a happy and fulfilling retirement does not necessarily require spending a lot of money. It’s true that the best things in life are free; for others, there are discounts.

Here are 26 steps you can take in your day-to-day life to reduce or eliminate expenses that won’t impact your quality of life.

[Editor’s Note: A lengthier version of this article appears here.]

What can you reduce or eliminate?

- Cable TV. Consider an internet streaming service such as Hulu, Netflix, or Amazon Prime, which cost approximately $8 per month.

- Landline phone service. Consider ditching your landline and using only your cell phone. These days, most landline calls are unwanted robo-calls. In the current era of email, texting, and Facebook messaging, people don’t talk on the phone nearly as much as they used to.

- Expensive cell phone plans. While modern cell phones offer many capabilities such as maps, internet access and texting, consider what you actually use and what you could do without. AARP’s Consumer Cellular plans start at under $10 a month.

- Gym memberships. If you use the gym regularly, then your membership fee provides good value. But if your road to the gym is paved with good intentions, yet you rarely go, cancel it. Some health insurance plans offer free or reduced gym memberships through the Silver Sneakers program.

- Cars. After you retire, you can probably get by with just one car or perhaps no car at all. The cost of Uber, Lync, taxis or bus passes may seem like a lot of money trickling out of your pocket, but when you consider the money you’re not spending on gas, maintenance, license fees and insurance, it’s probably much less expensive. You can rent a car when you want to take a weekend trip or have a special need.

- Subscriptions. If you find that you don’t regularly read the magazines or newspapers you subscribe to, don’t renew them next time they come due. Most of their content is available online. If you subscribe to anything else that arrives at a regular interval, such as books, music, or wine, consider whether you would be better off buying these items only when you need them. Subscription deals always work in favor of the seller.

Become a smarter shopper.

- Shop online. It’s easier to compare prices, which can help you snag better deals. While you can’t see and touch the item in person, you gain the benefit of reading other people’s reviews and comparing prices and features from multiple sources side-by-side. If you see a box for a promotion code or coupon code during the checkout process, go to CurrentCodes.com or use Google to search for a coupon code.

- Use coupons. While it can be a hassle to cut out, collect, and carry coupons, they really do save money. Be careful not to buy stuff just because it seems cheaper. Buy only those items you regularly use or have a current need for.

- Stock up on things when they are on sale. But don’t stockpile things that may expire before you get a chance to use them.

- Own a stand-alone freezer. This allows you to take advantage of sales, and you can buy the larger quantities that are sold at wholesale clubs such as Costco and Sam’s Club.

- Check out grocery store loyalty programs. Many stores offer special deals to customers who belong to their loyalty program. You can load coupons onto your account, eliminating the need for paper coupons. In some markets, stores offer discounts at local gas stations or they will contribute money to a non-profit of your choice based on the amount of your purchases.

- Senior discounts. Don’t be bashful or self-conscious about asking for discounts. In many markets, the major grocery chains offer a 10% discount to people over 55 on a certain day every month. Find out what’s available in your area.

- Check your receipt. Watch the monitor screen at the cashier station and check your receipt before you leave the store. You might be surprised how often sale prices and loyalty card discounts are not applied properly.

- Visit dollar stores and discount outlets. Maybe it’s not elegant, but dollar stores and discount outlets such as Big Lots, TJ Maxx, Marshall’s, and Home Goods offer fantastic values. However, resist the temptation to buy things just because they are cheap.

- Avoid shopping malls. Mall stores rarely offer good prices. They thrive on price-insensitive shoppers who browse the stores for recreational shopping.

- Look for the best value. The best value is often not the cheapest option. If the item wears out or breaks quickly you haven’t really saved money. Conversely, the most expensive options are usually loaded with features you don’t need. The sweet spot is usually somewhere in the middle, where you will find the ideal combination of price and quality. Consumer Reports (the magazine or the website) is an excellent resource for finding the best value for many items that you purchase.

- Get insurance quotes at least every two years. Insurance companies know that once you sign on with them, you will probably automatically renew each year. While it’s easy to get quotes online, it may help to speak to an agent and ask if there is anything they can do to lower your rates.

- Buy ebooks books rather than physical books. Ebooks are cheaper, they don’t take up space, they are easier to travel with, and you save on shipping. If you don’t have a Kindle device, Amazon offers a free Kindle reader app for most modern computers, tablets, and smartphones.

Why pay for what you can get for free?

- Libraries. Use your local library for books, music, and movies.

- Volunteer to be an usher at a theatre or concert hall. After patrons are seated, you can enjoy the performance for free.

- Free wi-fi. If you are a light internet user, you may be able to get by without internet service to your home unless you are using an internet streaming TV service. Starbucks and other coffee shops offer free wi-fi, and some restaurant chains are following suit. Your local library may offer free wi-fi.

Seek out discounts for local entertainment.

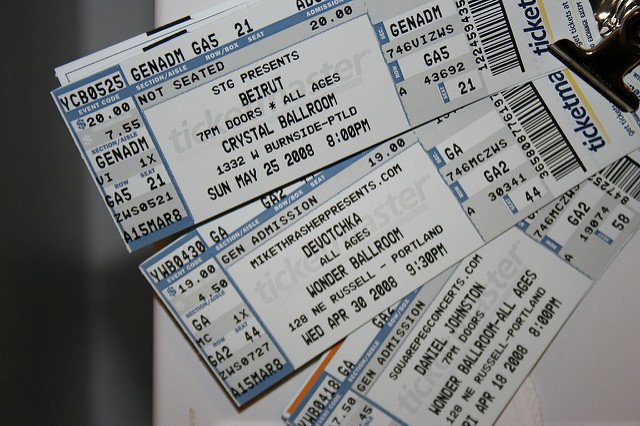

- Discounted or free tickets. Goldstar.com offers substantial discounts to local productions and some national touring acts in many major cities. Check out VetTix.com if you’re a veteran.

- Colleges. Local colleges offer many types of performances that are usually free to the public. They are usually of good quality, and the students will appreciate having an audience to perform for.

- Museums. Many museums have free days or evenings on a weekly or monthly basis.

- Theatres. Theatres may offer discounted admissions to pre-opening night dress rehearsals or abbreviated lunchtime performances.

- Eat out less expensively. Avoid appetizers, alcohol, and desserts; these are the higher mark-up items. You can enjoy these at home before or after you go. Eat out at lunch rather than at dinner, because many restaurants have cheaper lunch menus. Look for coupons, senior discounts and deals through sites such as Groupon and Living Social. Sign up for the email list of the restaurants you dine in most often.

What are your favorite ways to get more bang for less buck? Please share in the comments below.

Reprinted from my blog on U.S. News – On Retirement.

© 2016 Dave Hughes. All rights reserved.

Photo credits:

Ladies laughing: David Fulmer. Some rights reserved.

Landline phone: David Wilson. Some rights reserved.

Coupons: Chris Potter. Some rights reserved.

Library: Ken Hawkins. Some rights reserved.

Tickets: Robin Zebrowski. Some rights reserved.

3 Responses

This is some great insight to options. Many I never thought of before reading the article. These will help me save more now before retirement. Thank you.

I use Roku but There is also Apple TV, Google and Amazon Tv. For A small initial investment you can subscribe to whatever you want at considerable cost savings. I am able to stream live CBS and watch all the shows later ad free for $10 a month. I als can watch the Smithsonian channel, watch Amazon Prime etc. it’s very versatile and you can buy just what you want. I just bought a streaming stick for travel. You connect in the HDMI on the hotel TV, connect to the free wifi and you can watch whatever you want.

Thanks for letting us know about the additional possibilities for TV streaming. I think cable TV, as we have known it for years, is rapidly becoming a thing of the past. With everything that is available, it’s easier than ever to spend too much time in front of the TV! 🙂